A Guide To California Income Tax For 2020 Returns

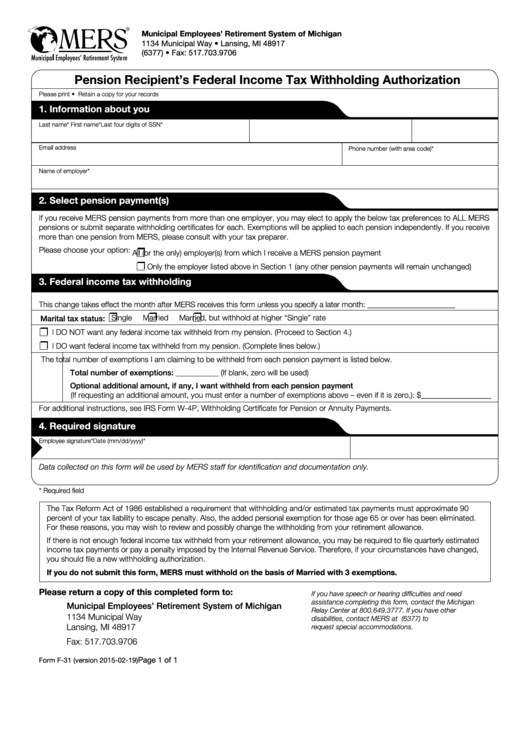

Authorization to release income tax return information. federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation of and filing of your tax return. Federal income tax rates and withholding often seem opaque to both employees and employers. as an employee, you are surprised to see that your paycheck is well below what you might expect from the monthly salary agreed to with your employer. Find tax release. search a wide range of information from across the web with fastsearchresults. com. Find tax release. search a wide range of information from across the web with quicklyanswers. com.

Authorization To Release Income Tax Return Information

This form authorizes the release and sharing of individual release return authorization tax information to income information which includes: prior year tax returns and supporting document associated with those tax returns, as well as personal information such as name, birth date, social security number,. Personal income taxes contains articles that explain different aspects of the tax system. learn about taxes on our personal income tax channel. advertisement taxes are inevitable, but if you are educated, you can soften their impact. learn. State income tax is different from the federal income tax. this is the amount you pay to the state government based on the income you make, as opposed to federal income tax that goes to the federal government. that said, 50 states income ta.

Wvari001 Authorization To Release Information State Tax Rev

If you're having trouble gathering all of your financial documents by the april 15th filing deadline, you'll need to file your taxes late. you can obtain a six-month extension by filing form 4868. if you don't file your return by the end of. Under internal revenue code (irc) section 7216 and its concomitant regulations, a tax preparer must obtain the consent of a taxpayer before disclosing or using the taxpayer’s tax return information when that consent is required. section 7216 makes it a crime for any preparer to knowingly or recklessly disclose any information that is furnished to the preparer in connection with preparing a client’s tax return, or use tax return information other than to prepare or assist in preparing. Search for filing returns online at searchstartnow. com. search release return authorization tax information to income for filing returns online that are right for you!. California has one of the highest income tax rates in the country but the state offers several unique deductions, credits, rates and income exclusions. fidelity wealth management california's income tax system differs from the federal tax s.

Online Results

Need your old federal tax returns or forms? here is how you can order exact copies or transcripts from the irs and why you might need them. you can get either exact copies or brief “transcript” of your past u. s. federal tax returns from the. For millions of americans, filing taxes for 2020 has the potential to be the most complicated year of tax returns in decades. that’s largely due to the economic and other effects of the covid-19 pandemic. a record number of americans — apri. As the old adage goes, taxes are a fact of life. and the more we know about them as adults the easier our finances become. there are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. Authorization is for: • release of personal income tax return(s); if jointly filed personal income tax return is requested, the authorization must be signed by either the husband or the wife. • release of a return filed by a business that is a sole proprietorship, the authorization must be signed by the owner.

Finance Software Question

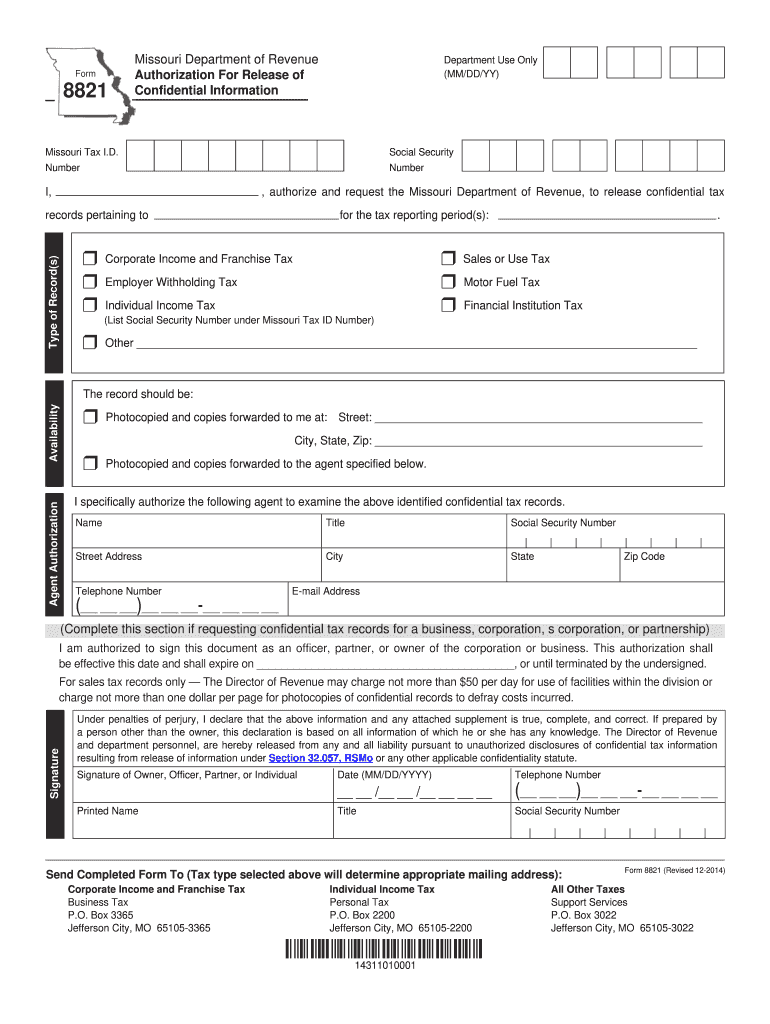

About form 8821, tax information authorization. authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential release return authorization tax information to income information verbally or in writing for the type of tax and the years or periods listed on the form. delete or revoke prior tax information authorizations. View auth-to-release-income-tax-form. docx from pl 30 at texas a&m university. authorization to release income tax return information federal law requires this consent form be provided to you. unless.

Authorization to release income tax return information federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation and filing of your tax return. if you consent to the disclosure of your tax. Get the answers you're looking for. connect 1-on-1 with a real tax pro in just minutes. Must be diligent in our efforts to secure financial information. the attached authorization will be valid for current clients. because of the obvious security concerns and the gramm-leach bliley act lindenbusch accounting and tax service, inc. will only release tax information if this authorization is properly signed and filled out.

Authorization to release income tax return information federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation of and filing of your tax return. if you consent to the disclosure of your tax. Authorization to release income tax return information federal law requires this consent form be provided to you. unless authorized release return authorization tax information to income by law, we cannot disclose your tax return information to third parties for purposes other than the preparation and filing of your tax return, without your written consent. if you consent to the disclosure of your.

Information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. form 8821 is used to authorize certain entities to review confidential information in any irs office for the type of tax and the years or periods listed. Authorization to release income tax return information. federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation of and filing of your tax return. if you consent to the disclosure of your. The upcoming tax season for preparation of your tax return. authorization to release and share information: i hereby give my consent for my information to be shared with zimmerman & co cpas inc to be used in conjunction with the preparation of my individual income tax return for the. Authorization to release income tax return information revised010418 federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation and filing of your tax return. if you consent to the disclosure.

Filing taxes on income earned from working at a polling place during a general or primary election isn't difficult, but you do have to pay attention to your fica contributions. if you earn more than $600 as a poll worker, you will receive a. The american tax system isn’t known for being the most straightforward set of laws and processes to follow, and being responsible for determining what you owe each year can seem confusing — if not a little anxiety-inducing, too. fortunately.